Delving into Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

The content of the second paragraph that provides descriptive and clear information about the topic

Overview of High-Risk Drivers

When it comes to car insurance in Canada, being classified as a high-risk driver can have significant implications on your premiums and coverage options. High-risk drivers are individuals who insurance companies consider to be more likely to get into accidents or file claims based on their driving history and other risk factors.Factors that may lead to being categorized as a high-risk driver include a history of traffic violations, accidents, DUI convictions, driving without insurance, or being a new driver with limited experience.

These factors signal to insurance companies that there is a higher likelihood of these drivers being involved in future incidents.The implications of being a high-risk driver on insurance premiums are quite significant. Insurance companies typically charge higher premiums to high-risk drivers to offset the increased likelihood of having to pay out claims.

This means that high-risk drivers often face much higher insurance costs compared to standard-risk drivers with clean driving records.In comparison to standard-risk drivers, high-risk drivers may face more limited coverage options, higher deductibles, and stricter policy terms. Insurance companies may also require high-risk drivers to carry specific types of coverage, such as comprehensive and collision insurance, to protect against potential financial risks.

Understanding Discount Car Insurance

When it comes to car insurance, high-risk drivers in Canada may struggle to find affordable coverage. However, discount car insurance can provide a solution by offering reduced rates to those who qualify.

Definition of Discount Car Insurance

Discount car insurance is a type of insurance that provides lower premiums to drivers who meet certain criteria set by the insurance provider. These discounts can help offset the higher costs typically associated with high-risk drivers.

- Good Driver Discount: This discount is offered to drivers with a clean driving record, free of accidents or traffic violations.

- Multi-Policy Discount: Insuring multiple vehicles or bundling car insurance with other policies, like home insurance, can result in discounted rates.

- Low Mileage Discount: Drivers who don't drive often may qualify for lower premiums due to reduced risk of accidents.

How Discounts Benefit High-Risk Drivers

Discounts can be a game-changer for high-risk drivers as they provide an opportunity to lower their insurance premiums despite their driving history. By taking advantage of available discounts, high-risk drivers can make insurance more affordable.

- Improving Driving Habits: High-risk drivers can work towards improving their driving habits to qualify for discounts like the good driver discount.

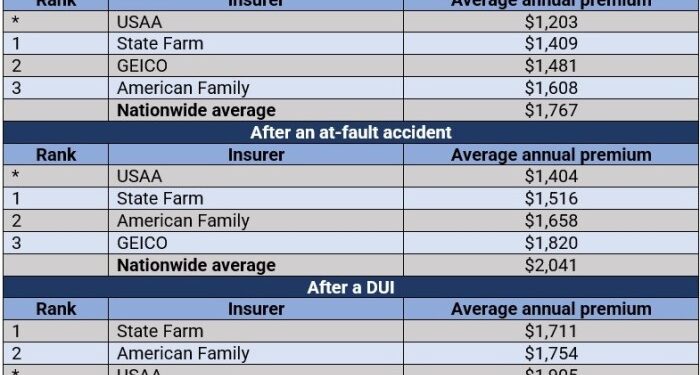

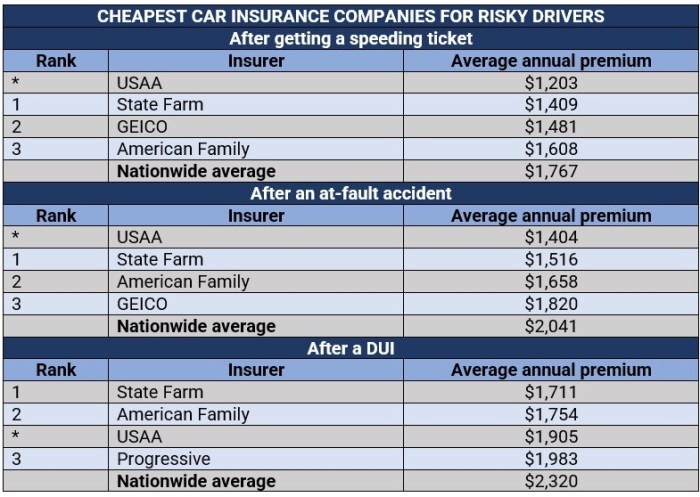

- Comparison Shopping: It's essential for high-risk drivers to compare quotes from different insurance companies to find the best discounts and rates.

Tips for High-Risk Drivers to Lower Insurance Premiums

Driving as a high-risk driver can come with expensive insurance premiums. However, there are strategies you can implement to reduce your insurance costs and potentially save money in the long run.

Maintaining a Clean Driving Record

- One of the most effective ways to lower your insurance premiums as a high-risk driver is to maintain a clean driving record. Avoiding traffic violations, accidents, and other infractions can demonstrate to insurance companies that you are a responsible driver.

- Insurance companies often reward drivers with clean records by offering lower premiums and better discounts.

Defensive Driving Courses

- Another way to potentially reduce your insurance rates is by taking defensive driving courses. These courses can help improve your driving skills, reduce the likelihood of accidents, and show insurance companies that you are committed to safe driving practices.

- Many insurance providers offer discounts to drivers who have completed approved defensive driving courses, so it's worth considering this option to lower your premiums.

Bundling Insurances

- One often overlooked strategy to save money on car insurance is by bundling your policies. By combining your auto insurance with other types of insurance, such as home or renters insurance, you may be eligible for significant discounts.

- Insurance companies typically offer discounts for bundling policies, making it a convenient and cost-effective way for high-risk drivers to lower their insurance premiums.

Comparing Insurance Quotes for High-Risk Drivers

When it comes to obtaining car insurance as a high-risk driver in Canada, comparing insurance quotes is crucial to find the best coverage at an affordable rate. Understanding the process and key factors to consider can help you make an informed decision and save money in the long run.

Factors to Consider When Comparing Quotes

- Policy Coverage: Look at the type of coverage offered in each quote, including liability, collision, comprehensive, and any additional options. Make sure the policy meets your needs and provides adequate protection.

- Cost and Premiums: Compare the total cost of the policy, including premiums, deductibles, and any discounts available. Consider both the upfront costs and long-term affordability of the insurance.

- Insurance Company Reputation: Research the insurance company's reputation, customer service, and claims process. Choose a reputable insurer with a history of fair treatment and reliable service.

- Discounts and Savings: Inquire about any discounts or savings opportunities available, such as safe driver discounts, bundling policies, or completing a defensive driving course.

Significance of Coverage Limits and Deductibles

- Coverage Limits: Understand the maximum amount your insurance will pay for a covered claim. Consider your assets and potential liabilities when selecting coverage limits to protect yourself financially.

- Deductibles: Evaluate the deductible amount, which is the out-of-pocket expense you must pay before insurance coverage kicks in. A higher deductible typically results in lower premiums but requires more upfront costs in case of a claim.

- Balance Coverage and Costs: Find a balance between coverage limits, deductibles, and premiums that suits your budget while providing adequate protection in case of an accident or claim.

Tips for Analyzing and Choosing the Best Quote

- Compare Multiple Quotes: Obtain quotes from several insurance companies to compare coverage, premiums, and discounts. Don't settle for the first quote you receive.

- Review Policy Details: Carefully review the policy details, including coverage exclusions, limitations, and terms. Ask questions and seek clarification on anything you don't understand.

- Consider Long-Term Costs: Look beyond the initial premium and consider the long-term costs of the policy, including potential rate increases, renewal terms, and overall value.

- Seek Professional Advice: If you're unsure about which quote to choose, consider seeking advice from an insurance broker or agent who can help you navigate the process and find the best coverage for your needs.

Wrap-Up

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Answers to Common Questions

What factors classify a driver as high-risk in Canada?

Drivers with multiple traffic violations or accidents on record are often considered high-risk in Canada.

How can high-risk drivers lower their insurance premiums?

High-risk drivers can lower their premiums by maintaining a clean driving record, taking defensive driving courses, and bundling insurances for discounts.

What are some common discounts available to drivers?

Common discounts include safe driver discounts, multi-policy discounts, and discounts for vehicles with safety features.