Embark on a journey to understand Costco Car Insurance Coverage Explained for Saudi Arabia Residents, where we unravel the intricacies of car insurance in the region.

Delve into the specifics of different coverage options and eligibility criteria to make informed decisions.

Introduction to Costco Car Insurance Coverage in Saudi Arabia

Car insurance coverage is a policy that provides financial protection against physical damage and bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. In Saudi Arabia, having car insurance is mandatory by law, and it is crucial for safeguarding both drivers and vehicles on the road.Costco has partnered with reputable insurance providers in Saudi Arabia to offer a range of car insurance coverage options to residents.

This collaboration ensures that Costco members have access to reliable insurance services that meet their specific needs and requirements. By leveraging these partnerships, Costco aims to provide comprehensive and affordable car insurance solutions to customers in the region.

Partnership between Costco and Insurance Providers

Costco's partnership with insurance providers in Saudi Arabia allows for a seamless and efficient process for Costco members to secure car insurance coverage. Through these partnerships, Costco is able to offer competitive rates, tailored coverage options, and exceptional customer service to its members.

This collaboration underscores Costco's commitment to delivering value and quality services to its customers in the region.

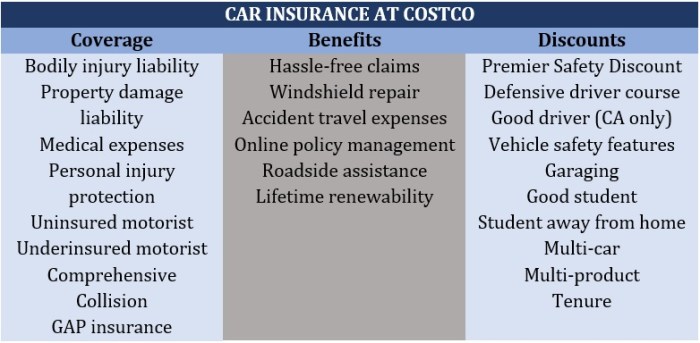

Types of Car Insurance Coverage Offered by Costco in Saudi Arabia

When it comes to choosing car insurance coverage in Saudi Arabia, Costco offers a variety of options to suit different needs and budgets. Understanding the different types of coverage available can help you make an informed decision that best protects you and your vehicle.

Comprehensive Coverage

Comprehensive coverage is the most extensive type of car insurance offered by Costco. It provides protection for damages to your vehicle caused by accidents, theft, vandalism, natural disasters, and other non-collision incidents. With comprehensive coverage, you can have peace of mind knowing that your vehicle is safeguarded in various situations.

Third-Party Liability Coverage

Third-party liability coverage is a mandatory type of car insurance in Saudi Arabia. This coverage protects you against claims from third parties for bodily injury or property damage caused by your vehicle. Costco offers competitive rates for third-party liability coverage to ensure you comply with the legal requirements while driving in the country.

Collision Coverage

Collision coverage is another option provided by Costco, which covers damages to your vehicle resulting from collisions with other vehicles or objects. This type of coverage can help cover repair costs or even the replacement of your vehicle in the event of a total loss due to a collision.

Personal Injury Protection

Personal Injury Protection (PIP) coverage is designed to cover medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. Costco's PIP coverage ensures that you have financial protection for medical bills and other related expenses resulting from an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage provides protection if you are involved in an accident with a driver who does not have insurance or lacks sufficient coverage to pay for damages. Costco's UM/UIM coverage can help cover medical expenses, lost wages, and other damages in such situations.By offering a range of car insurance coverage options, Costco aims to provide comprehensive protection for Saudi Arabia residents.

It is important to carefully consider the benefits and limits of each type of coverage to ensure you have the right level of protection for your driving needs.

Eligibility Criteria and Requirements for Costco Car Insurance Coverage

In order to obtain car insurance coverage through Costco in Saudi Arabia, residents must meet specific eligibility criteria and provide certain documents and information during the application process. Below are the details on what is required:

Eligibility Criteria for Saudi Arabia Residents

- Saudi Arabian citizenship or valid residency permit

- Valid driver's license issued by the Saudi Arabian authorities

- Minimum age requirement set by Costco for car insurance coverage

Necessary Documents and Information

- Copy of Saudi Arabian national ID or residency permit

- Copy of valid driver's license

- Vehicle registration documents

- Information about the vehicle to be insured, including make, model, and year

- Driving history and any previous insurance claims, if applicable

Guidance for Application Process

- Ensure all documents are valid and up to date before submitting the application

- Fill out the application form accurately and provide all necessary information

- Review the terms and conditions of the car insurance coverage offered by Costco

- Contact Costco customer service for any assistance or clarification during the application process

Cost Factors and Premium Calculation for Costco Car Insurance in Saudi Arabia

When it comes to determining the cost of car insurance coverage in Saudi Arabia through Costco, various factors come into play. Understanding these factors and how premiums are calculated can help residents make informed decisions when selecting their insurance plan.

Factors Influencing Insurance Costs

- The type of coverage chosen: Comprehensive coverage will typically cost more than basic third-party liability coverage.

- The age and model of the vehicle: Newer and more expensive vehicles often have higher insurance premiums.

- The driver's age and driving record: Young drivers or those with a history of accidents may face higher premiums.

- The location where the car is primarily driven: Areas with higher rates of accidents or theft may result in increased premiums.

- The deductible amount selected: Opting for a lower deductible will lead to higher premiums.

Premium Calculation Methods

Costco and its partner insurance companies in Saudi Arabia use various methods to calculate premiums, taking into account the factors mentioned above. One common method is to assess the risk associated with insuring a particular driver and vehicle combination.

Insurance premium = Risk assessment of driver and vehicle + Chosen coverage + Additional factors

Impact of Variables on Insurance Cost

- Example 1:A young driver with a sports car may pay more for insurance compared to an older driver with a family sedan due to higher risk associated with younger drivers and sports cars.

- Example 2:Choosing comprehensive coverage for a brand new luxury vehicle will result in higher premiums compared to opting for basic coverage for an older, more affordable vehicle due to the vehicle's higher value and associated risk.

- Example 3:Selecting a lower deductible may provide more financial protection in case of an accident but will lead to increased premiums to offset the insurance company's potential payout.

Claims Process and Customer Support for Costco Car Insurance Policyholders

When it comes to dealing with unexpected events on the road, understanding the claims process and having access to reliable customer support are crucial aspects of any car insurance policy. Here's a guide on how Saudi Arabia residents with Costco car insurance coverage can navigate through the claims process and seek assistance when needed.

Claims Process for Costco Car Insurance Policyholders

- Immediately contact the insurance provider: In case of an accident or damage to your vehicle, notify Costco car insurance promptly to initiate the claims process.

- Provide necessary information: Be prepared to share details such as your policy number, location of the incident, description of the event, and any relevant documentation.

- Assessment and inspection: The insurance provider may conduct an assessment or inspection of the damage to determine the extent of coverage and necessary repairs.

- Approval and settlement: Once the claim is processed and approved, you will receive the necessary compensation or assistance as per your policy coverage.

Customer Support Options for Policyholders

- 24/7 Helpline: Costco car insurance offers a 24/7 helpline for policyholders to report emergencies, file claims, or seek assistance round the clock.

- Online Portal: Policyholders can access their accounts through an online portal to track claims, policy details, and communicate with customer support representatives.

- Local Branches: Costco may have physical branches or partner locations where policyholders can visit for in-person support or guidance on claims processing.

Additional Benefits and Services Included in Costco Car Insurance Coverage

When you choose Costco for your car insurance needs in Saudi Arabia, you not only get comprehensive coverage but also access to a range of additional benefits and services that can enhance your overall insurance experience.

24/7 Roadside Assistance

- Costco offers 24/7 roadside assistance to its policyholders, providing help in case of emergencies like flat tires, battery jump-starts, or towing services.

- This service ensures that you are never stranded on the road and can get prompt assistance whenever you need it.

Free Car Rental Service

- In the event of a covered accident, Costco provides a free car rental service to policyholders, allowing them to continue their daily activities while their vehicle is being repaired.

- This benefit helps minimize the inconvenience caused by an accident and ensures that you stay mobile during the repair process.

Online Account Management

- Costco offers an online portal for policyholders to conveniently manage their insurance policies, make premium payments, and access policy documents anytime, anywhere.

- This feature makes it easy for customers to stay updated on their coverage and make any necessary changes to their policies.

Discounts and Rewards Program

- Costco provides discounts and rewards to loyal customers, offering incentives for safe driving habits and policy renewals.

- By participating in the rewards program, policyholders can enjoy additional savings and benefits over time.

Last Point

In conclusion, Costco Car Insurance Coverage provides a comprehensive solution for residents in Saudi Arabia, offering peace of mind and valuable benefits.

General Inquiries

What types of car insurance coverage does Costco offer in Saudi Arabia?

Costco offers comprehensive, third-party liability, and other types of coverage tailored to residents' needs.

What documents are required to apply for Costco car insurance in Saudi Arabia?

Documents like proof of identity, vehicle registration, and driver's license are typically needed for the application process.

How can Saudi Arabia residents streamline the application process for Costco car insurance?

Residents can ensure a smooth application process by preparing all necessary documents in advance and meeting the eligibility criteria set by Costco.